Gianni Martins has been the General Director of Alfort Petroleum since September 1, 2022. He holds a Bachelor’s and Master’s degree in Petroleum Engineering from the University of Tulsa in the United States. With over 21 years of experience in the oil sector, he began his professional career at Chevron, CABGOC, in 2002 as an intern in the Reservoir Management Department. In 2007, after completing his higher education, he joined Sonangol, working in the Upstream sector within the Production Directorate (DPRO) of the former National Concessionaire. In 2014, he left the state-owned company and embraced a new challenge, starting his private business career as Chairman of the Board of Directors at Global Inn Investments, an investment company in the oil and mining sectors. Currently, in addition to his executive role at Alfort Petroleum, he also serves as a Board Member at Banco BIC and Sanlam Angola Seguros. He is an active participant in the social arena as the President & Founder of GGMF, a non-profit Non-Governmental Organization dedicated solely to philanthropy.

“Onshore development is indeed a new frontier for Angola. The novelty of onshore exploration in Angola means we are breaking new ground, creating opportunities and addressing gaps.”

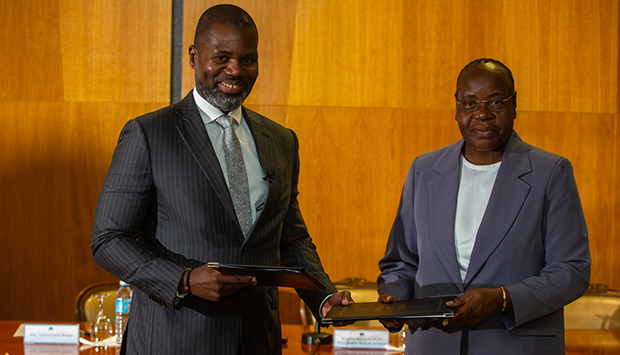

TBY talks to Gianni Martins, CEO of Alfort, about the company’s position in the market, collaborating with local providers, and the development of the onshore oil sector.

Could you provide an overview of how Alfort has positioned itself in this market?

We were established 17 years ago, initially as a service company. Recently, we transitioned into an E&P company, making us newcomers in this role. We participated in the licensing rounds in 2015, which was canceled, and in 2020. We are currently focused on our exploration activities, primarily onshore. This shift was catalyzed by the Angolan government creating opportunities for local companies to enter the Oil & Gas Sector. My personal background has been instrumental in navigating this transition. Coming from a regulatory role about a decade ago, I was well-versed in the “Dos” and “Don’ts”, which helped us strategically position ourselves. Unlike many newcomers, we have adopted a very cautious approach, focusing on a single concession. This decision reflects our commitment to sustainability and controlled growth. The sector had been stagnant for some time, but the establishment of the ANPG revitalized the industry, creating opportunities for companies such as ours. This has been a transformative journey, and while the challenges remain, the potential is enormous.

Are there specific areas where you see potential for collaboration with organizations in Angola?

As a local player, we prioritize empowering local service providers. Another key focus is integrating additional members into our concession. These synergies, rather than traditional partnerships, are central to our approach. We have also been fortunate enough to secure strong financing for our operations, granting us the flexibility to execute our plans effectively. Currently, we are in the advanced stages of exploration, with our seismic acquisition program completed. Given that it is an onshore development, the timeline from exploration to production is shorter than offshore projects. Our cautious approach means we have concentrated on specific areas we deem prolific within our concession, rather than expanding to other concessions. This focus allows us to move efficiently while minimizing risks. International synergies are likewise critical, especially in a high-risk industry like ours. The current global focus on energy transition and environmental considerations has made securing funding challenging. Banks are hesitant, but private equity funds, independent oil companies, and trading houses like Trafigura or Vitol, etc., have become vital sources of financing. For specialized services, we often rely on international expertise. While local providers are improving, the Angolan oil sector still lacks the depth of specialized capabilities required for complex operations. Opting for experienced international partners ensures operational reliability and risk mitigation.

Could you elaborate on the technology Alfort uses for onshore exploration?

We are currently focused on seismic acquisition, which is relatively non-invasive. For non-specialists, seismic acquisition might sound dramatic, but it is essentially an ultrasound of the Earth. Pulses are sent into the ground, and the returning signals create a detailed subsurface map. This method allows us to identify potential resources without significant disruption. We are particularly excited about the potential of our concession. It holds promise for reversing Angola’s production decline, which has persisted in recent years. We believe our findings will be a pleasant surprise for the industry.

Given increasing demand and confined operational spaces, how do you plan to increase supply to meet market needs?

This is where regulatory support plays a crucial role. Ideally, we would have infrastructure in place, much like in the US, where producers can tap into existing networks. In Angola, confined concession spaces present logistical challenges, but the Regulator has given us the flexibility to innovate. If our exploration program succeeds, we will likely need to develop logistical solutions to transport oil and gas efficiently. This presents an exciting challenge, allowing us to design our blueprint for integrated operations. The novelty of onshore exploration in Angola means we are breaking new ground, creating opportunities and addressing gaps.

Angola’s oil sector has historically favored offshore operations. How does this influence onshore development?

Onshore development is indeed a new frontier for Angola. During the civil war, operations focused mainly offshore to avoid conflict zones, leaving onshore potential largely untapped. Even now, major oil companies prefer offshore projects due to fewer interface with key stakeholders such as local communities. However, as a local player, we view onshore exploration as a unique opportunity. It enables us to engage with communities and other stakeholders in ways offshore projects cannot.

The Angolan government has forecast USD60 billion in investment over the next five years. How does Alfort view this potential, and what are your plans for growth?

The USD60 billion projection reflects Angola’s vast potential, though it likely encompasses investments across multiple sectors. Oil and gas should serve as a catalyst for diversifying Angola’s economy. At Alfort, we aim to contribute to this growth by maintaining a steady supply of energy while preparing to expand. While we have been cautious in our early years, we are maturing into a more ambitious company. Future plans include pursuing additional concessions and exploring opportunities in neighboring countries like Namibia. Namibia’s emerging energy sector is particularly attractive due to its proximity and stability. However, our expansion will remain focused and strategic, prioritizing opportunities that align with our capabilities and resources.

Besides Namibia, are there other regional markets you are considering?

Namibia is a high-priority market due to its historical ties to Angola. Mozambique is another potential market, given its significant growth prospects; however, Mozambique faces challenges that may require larger players to address effectively. As a relatively small company, our strategy requires a gradual expansion. Once we consolidate our position in Angola, we plan to explore Namibia and may consider Mozambique or other markets, depending on how circumstances evolve.

What’s next for Alfort as you navigate this evolving landscape?

Our immediate focus is completing our exploration program and confirming the potential of our current concession. Beyond that, we are keen to leverage relinquished assets from major players and expand our footprint in the region. Angola’s onshore sector is still in its infancy, and we are excited to be part of its development. With careful planning, strategic partnerships, and a commitment to sustainability, Alfort aims to become a key player in Angola’s energy sector and beyond. The opportunities are immense, and we are ready to seize them.

Fonte: The Business Year